The Washington Health Plan Finder income guidelines vary based on household size and income. Eligibility for subsidies is based on the federal poverty level (FPL).

Navigating health insurance options can be challenging, but understanding the Washington Health Plan Finder income guidelines is crucial for residents seeking coverage. This online marketplace provides a platform for individuals and families to compare and enroll in health insurance plans, with potential financial assistance for those who meet certain income criteria.

The income guidelines are designed to extend affordable healthcare coverage by offering subsidies to qualified applicants. These subsidies are determined by the applicant’s household income in relation to the FPL, which adjusts annually. The process is user-friendly, aiming to help Washingtonians find a suitable health plan that aligns with their financial situation. With the appropriate health coverage, residents can access necessary medical services, contributing to the overall well-being of the community.

Credit: www.medicareplanfinder.com

Washington Health Plan Finder Income Guidelines

Explore the Washington Health Plan Finder income guidelines to determine eligibility for affordable healthcare coverage. Navigate through the specific income thresholds that qualify individuals and families for various insurance plans tailored to their financial situation.

Understanding Washington Health Plan Finder Income Guidelines

Navigating health insurance can be complex, but it’s crucial to know how income affects your options on the Washington Health Plan Finder. This state’s marketplace offers a range of coverage plans tailored to income levels to ensure that residents can find an affordable and suitable health insurance plan.

Eligibility Criteria For Subsidized Plans

Before diving into specific income guidelines, it’s important to recognize:

- Income thresholds: These determine eligibility for premium tax credits and other savings which can lower the cost of your insurance.

- Household size: Your family size significantly impacts the income bracket you fall into and the assistance you could receive.

Determining Your Income Bracket

Income calculations might seem daunting, but they are a vital step:

- Total household income: This includes the total of everyone’s income in your home, not just your own.

- Types of income: Consider all types such as wages, salaries, tips, business income, and unemployment benefits.

Making Sense Of The Numbers

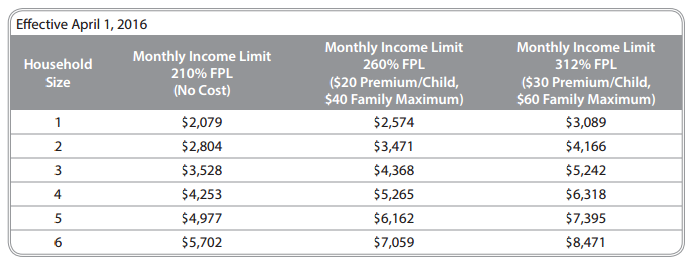

The Washington Health Plan Finder categorizes households based on percentage brackets of the federal poverty level (FPL). Let’s break this down:

- Below 138% FPL: You may qualify for Washington Apple Health (Medicaid) at no cost.

- Between 138% and 400% FPL: You could be eligible for Advance Premium Tax Credits (APTCs) to reduce your insurance premiums.

Updating Your Information

Staying up to date ensures you receive the right assistance:

- Reporting changes: Always update any income or family changes promptly.

- Periodic checks: It’s good practice to review your information regularly, ideally before renewing your plan.

Seeking Assistance When Needed

If you’re unsure about where you stand or how to proceed:

- Customer support: Washington Health Plan Finder provides assistance through various channels.

- Consult experts: In-person navigators and brokers can guide you through more complex situations.

Navigating the Washington Health Plan Finder’s income guidelines requires a clear understanding of where your household stands financially. By adhering to the updated state resources and seeking help when needed, Washington residents can secure health insurance that’s affordable and tailored to their needs, thereby promoting overall wellbeing and financial stability.

Washington Health Plan Finder Problems

Navigating the Washington Health Plan Finder can be tricky, especially with income guidelines determining eligibility. Users often encounter issues when their reported incomes don’t neatly match the system’s requirements, leading to frustration and potential lapses in coverage.

Navigating Washington Health Plan Finder System Issues

Having trouble with the Washington Health Plan Finder can be a source of stress, particularly when you’re trying to meet the income guidelines and ensure you’re signing up for the right plan. For those encountering obstacles with the website, many find common problems that can impede the progress of their application process.

Addressing these issues promptly can mean the difference between seamless coverage and potential setbacks in healthcare management.

Eligibility Confusion

- Interface difficulties:

Many users report that the website interface can be confusing, leading to uncertainty regarding eligibility status and what information is needed.

- Inconsistent Information:

Instances of receiving conflicting information when toggling between pages or updates can leave individuals puzzled about their eligibility status under current income guidelines.

Technical Glitches And Errors

- Website Downtime:

Unexpected website maintenance or outages during the application process can cause delays and hinder users from meeting deadlines.

- Error Messages:

Frequent error messages when inputting data or navigating through the Health Plan Finder can complicate the process, leaving users unsure if their information has been saved or submitted correctly.

Account Access Problems

The last thing anyone wants is to be locked out of their account, especially when deadlines are looming. Yet, account access issues are a common complaint among Washington Health Plan Finder users. This can range from forgotten passwords to glitches that prevent users from logging in entirely, effectively barring them from managing their healthcare plans online.

Customer Support Challenges

- Long Wait Times:

Reaching out to customer support can be daunting due to lengthy wait times, especially during peak enrollment periods when assistance is most needed.

- Limited Assistance:

When users do get through, they sometimes find that help is limited, with representatives not always able to resolve complex website issues on the spot.

By recognizing these challenges and preparing for potential setbacks, Washingtonians can navigate the Health Plan Finder more effectively. While the system isn’t flawless, understanding its intricacies can help in achieving a smoother healthcare registration journey.

Washington Health Plan Finder Complaints

Navigating the Washington Health Plan Finder can be challenging, with users voicing concerns over income guidelines confusion. Ensuring accurate income reporting is crucial for eligible plan selection, yet discrepancies can lead to frustration and complaints.

Washington Health Plan Finder: Understanding The Complaints

Exploring the grievances associated with the Washington Health Plan Finder can shed light on areas where users expect enhancements and aid in navigating the system more effectively. Common complaints often revolve around aspects such as application difficulties, customer service issues, and coverage misunderstandings.

User Interface And Navigation Challenges:

- Difficulty in website navigation: Users report that finding the right information on the Washington Health Plan Finder’s website can sometimes be a maze-like experience, leading to frustration.

- Technical glitches during application: Some individuals encounter errors or site crashes when attempting to complete their health insurance applications, which can delay their access to necessary coverage.

Customer Service Experiences:

- Long wait times for assistance: Reaching out to customer support might test one’s patience as callers frequently face extensive hold times.

- Inconsistency in provided information: There’s a disparity in the information given by different customer service representatives, causing confusion among users seeking assistance.

Coverage And Benefit Misunderstandings:

- Confusion over plan details: A clear understanding of what is covered can sometimes elude subscribers, leading to unexpected out-of-pocket costs.

- Challenges with income verification: The process of verifying income to determine eligibility for subsidies is another common hurdle that users encounter, often due to complex documentation requirements.

By addressing these common concerns, users can hope for a smoother, more transparent experience with the Washington Health Plan Finder, ultimately ensuring that more residents of Washington have the health coverage they need.

Washington Health Plan Finder Income Limits

Discover eligibility for savings on health coverage through the Washington Health Plan Finder by understanding the updated income guidelines. Navigate the enrollment process with ease by staying informed about the set income limits tailored for residents of Washington State.

Understanding Washington Health Plan Finder Income Limits

Finding the right health insurance plan can be challenging, especially when trying to navigate income requirements. The Washington Health Plan Finder simplifies this process by offering a wide range of options based on income levels. Let’s dive into the specifics of what these income limits are and how they may apply to you.

Qualifications Based On Annual Income

- Household size and income thresholds:

Determining eligibility involves assessing your household income against the set thresholds. These income limits vary depending on the number of members in your household and are adjusted annually to reflect cost-of-living changes.

- Federal Poverty Level percentage:

Your income is compared to the Federal Poverty Level (FPL) to establish the types of plans you qualify for. Typically, lower percentages can result in reduced-cost or even free coverage options.

Variations For Different Health Plans

- Apple Health (Medicaid):

For qualifying for free coverage under Apple Health, your annual household income must not exceed a certain percentage of the FPL, which is more accommodating to lower-income individuals and families.

- Qualified Health Plans:

Those who earn more might not qualify for Medicaid but might still receive subsidies to offset premium costs for various Qualified Health Plans available through the marketplace.

Navigating the health insurance marketplace shouldn’t be a cumbersome task. With the Washington Health Plan Finder income guidelines clearly outlined, you can approach choosing a health plan with confidence, knowing that your financial standing is taken into account to provide the best possible coverage for you and your loved ones.

Remember, staying informed about these guidelines can make all the difference in securing affordable health insurance that meets your needs.

Washington Health Plan Finder Small Business

Navigating the Washington Health Plan Finder, small business owners can determine eligibility based on income guidelines. Accurate assessment aids in selecting affordable health insurance options tailored to meet financial thresholds.

Washington Health Plan Finder Small Business: An Overview

Navigating health insurance options can be daunting for small business owners. Yet, securing the right health plan is critical for the health of your employees and the success of your business. The Washington Health Plan Finder is a valuable resource that delivers an array of insurance solutions tailored to small businesses.

By understanding the income guidelines and available options, you can provide an essential benefit to your team while also managing your business finances efficiently.

Benefits Of Enrolling In Washington Health Plan Finder For Small Businesses

Small businesses stand to gain substantially when they opt for health plans through the Washington Health Plan Finder. Some of the advantages include:

- Cost Savings:

Many small businesses qualify for tax credits which can significantly lower the price of providing health insurance. These savings make it feasible for smaller entities to offer competitive benefits.

- Flexible Options:

Health insurance plans through the marketplace are diverse, allowing business owners to select coverage levels that best fit their financial capabilities and their employees’ needs.

- Improved Employee Retention:

Providing health insurance can lead to greater employee satisfaction and loyalty, which is instrumental in retaining top talent within your company.

- Simplicity and Support:

The platform is designed with user-friendliness in mind, offering assistance and resources at every step, from selecting a plan to enrollment.

Understanding Eligibility Criteria For Small Business Plans

Determining whether your small business is eligible for a health plan through the Washington Health Plan Finder is straightforward. Essential criteria include:

- Business Size:

You must have between 1 and 50 employees to be considered a small business under the program.

- Employee Enrollment:

A minimum percentage of your employees must elect to participate in the health plan offered by the marketplace.

- Contribution Level:

Businesses are generally required to contribute a certain percentage toward the employees’ premiums to partake in these plans.

Maximizing The Potential Of Health Plan Finder For Your Small Business

Crafting the perfect health insurance strategy through the Washington Health Plan Finder can be a game-changer. Remember to:

- Analyze your business needs:

Take stock of your workforce and their health insurance requirements to identify the most appropriate coverage options.

- Stay informed on income guidelines:

Regulations and guidelines can change, so keep abreast of the latest information to ensure compliance and maximize benefits.

- Engage with employees:

Involve your team in the health insurance selection process to uncover their preferences and foster a culture of inclusivity.

- Seek advice:

If you’re uncertain about any aspect of the health plans or income guidelines, don’t hesitate to consult with a professional or utilize the support services offered by the marketplace.

Managing your small business means making pivotal decisions that can influence the well-being of your team. With the right approach to the Washington Health Plan Finder, you can secure health insurance that bolsters your workforce and bolsters your bottom line.

Keep these insights in hand to navigate the world of health insurance with confidence and clarity.

Credit: www.woodlandschools.org

Frequently Asked Questions On Washington Health Plan Finder Income Guidelines

What Is The Income Limit For Washington Apple Health 2023?

The income limit for Washington Apple Health in 2023 varies based on household size and federal poverty level guidelines. Please check the Washington State Health Care Authority website for the most current income limits.

What Is The Income Limit For Medicaid In Washington State 2024?

The income limit for Medicaid in Washington state in 2024 is $17,609 for an individual and $23,792 for a family of two. Eligibility varies based on household size.

What Is The Highest Income To Qualify For Medicaid 2023?

The highest income to qualify for Medicaid in 2023 varies by state and household size. It’s typically set at up to 138% of the Federal Poverty Level for most adults under the Affordable Care Act’s expansion. Eligibility thresholds can differ, so check with your state’s Medicaid office for precise information.

What Is The Highest Income To Qualify For Obamacare?

The highest income to qualify for Obamacare subsidies is 400% above the federal poverty level. Eligibility varies based on household size and state of residence.

Conclusion

Navigating the Washington Health Plan Finder’s income guidelines is crucial for affordable coverage. It ensures you find the right plan within your budget. Keep updated on changes to stay informed. Assistance is available if needed; don’t hesitate to seek help for a seamless experience.

Your health coverage is worth this attention to detail.